Salary Tax Calculator Ontario 2020

You may still need to pay EI premiums and CPP contributions. These calculations are approximate and include the following non-refundable tax credits.

Income Tax Calculator Calculatorscanada Ca

Personal Income Tax Calculator - 2020 Select Province.

Salary tax calculator ontario 2020. An 8 provincial sales tax and a 5 federal. Calculate your combined federal and provincial tax bill in each province and territory. The calculator is updated with the tax rates of all Canadian provinces and territories.

The category of fishing and hunting guides is not considered in this calculator as it is very specific. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. The Ontario Basic Personal Amount was 10783 in 2020.

The Ontario salary calculator for 202021 Annual Tax Calculations. This tax calculator is used for income tax estimationPlease use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. This calculator is based on 2020 Ontario taxes.

For 2021 until september 30 2021 the province of Ontario as decided to make an increase in the minimum wage of 025 over 2020 from 14 to 1425 per hour. See how we can help improve your knowledge of Math Physics Tax Engineering and more. If you make less than 10880 then you are exempt from Ontarios provincial income tax.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or the. Enter your pay rate. Newfoundland Prince Edward Island Nova Scotia New Brunswick Quebec Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon.

This difference will be reconciled when you file your 2020 tax return. 25 000 - Taxes - Surtax - CPP - EI 20 80248 year net 2094464 52 weeks 40278 week net 40278 40 hours 1007 hour net You simply need to the the same. The amount can be hourly daily weekly monthly or even annual earnings.

7 rijen Easy income tax calculator for an accurate Ontario tax return estimate. If this is the case you may see a difference between your pay and the Payroll Deductions Online Calculator. To get the appropriate amount for your job category.

Enter your annual income taxes paid RRSP contribution into our calculator to estimate your return. Get started for free. The HST was adopted in Ontario on July 1st 2010.

Tax rates for previous years 1985 to 2020 To find income tax rates from previous years see the Income Tax Package for that year. The Ontario Income Tax Salary Calculator is updated 202122 tax year. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

For 2021 the basic personal amount is increasing to 10880. Canadian corporate tax rates for active business income. Ontario Salary Examples.

Your 2020 Ontario income tax refund could be even bigger this year. Free income tax calculator 2020 for Ontario residents is simple and easy to estimate your income tax refund for taxes owed and provincial tax brackets. As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay.

The HST is made up of two components. For 2018 and previous tax years you can find the federal tax rates on Schedule 1For 2019 2020 and later tax years you can find the federal tax rates on the Income Tax and Benefit ReturnYou will find the provincial or territorial tax rates on Form 428 for the. The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount.

Formula for calculating net salary The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. This is income tax calculator for Ontario province residents for year 2012-2020. After-tax income is your total income net of federal tax provincial tax and payroll tax.

Take for example a salaried worker who earns an annual gross salary of 25000 for 40 hours a week and has worked 52 weeks during the year. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. Find out your federal taxes provincial taxes and your 2020 income tax refund.

Usage of the Payroll Calculator. It is free for simple tax returns or gives you 10 discount for more. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony.

Ontario Provincial Income Tax Changes 2021. Ontario Annual salary calculator enter your Annual and enter simple. Your average tax rate is 220 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month. Canada income tax calculator. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

Calculate the tax savings your RRSP contribution generates. Rates are up to date as of June 22 2021. The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST.

2021 - Includes all rate changes announced up to June 15 2021. One of a suite of free online calculators provided by the team at iCalculator. Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13.

In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you-earn PAYE system. Current tax rates in Ontario and federal tax rates are listed below and check.

How To Calculate Income Tax In Excel

Simpletax 2017 Canadian Income Tax Calculator Income Tax Income Calculator

How To Create An Income Tax Calculator In Excel Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Wix Stores Setting Up Automatic Tax Calculation With Avalara Help Center Wix Com

How To Calculate Income Tax In Excel

Simple Tax Calculator For 2020 Cloudtax

Quebec Income Calculator 2020 2021

Bc Sales Tax Gst Pst Calculator 2021 Wowa Ca

How To Calculate Income Tax In Excel

Tax Calculator Estimate Your Income Tax For 2020 And 2021 Free

Ontario Income Tax Calculator Wowa Ca

How To Calculate Income Tax In Excel

Paycheck Calculator Take Home Pay Calculator

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

Paycheck Calculator Take Home Pay Calculator

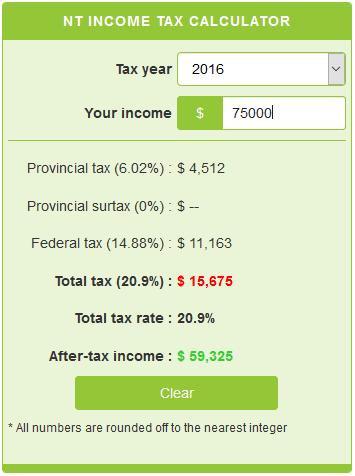

Northwest Territories Income Tax Calculator Calculatorscanada Ca

Post a Comment for "Salary Tax Calculator Ontario 2020"