Paycheck Calculator Texas Head Of Household

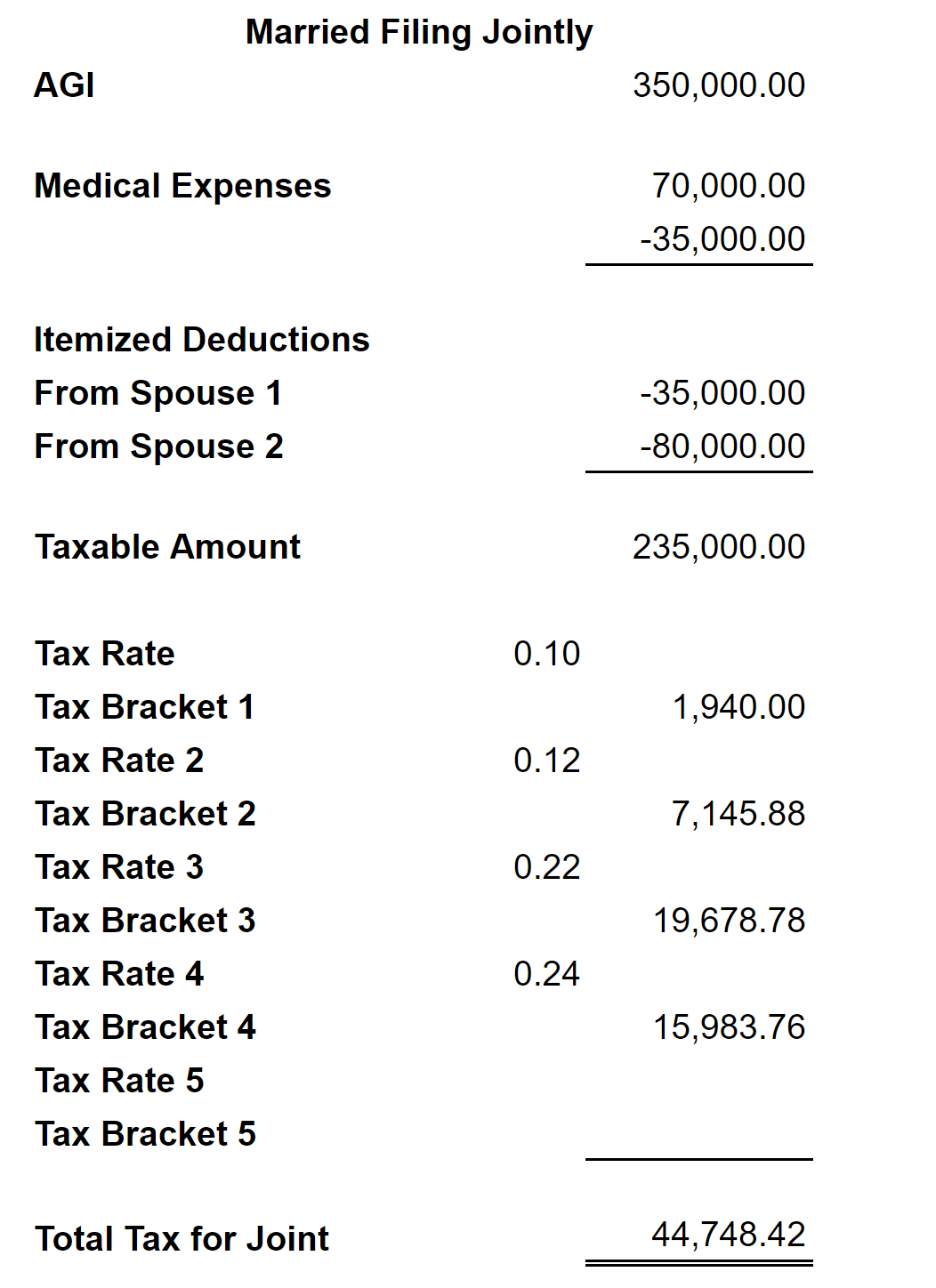

So your big Texas paycheck may take a hit when your property taxes come due. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a.

2019 Salary Paycheck Calculator 2019 Hourly Wage To Yearly Salary Conversion Calculator

Fill in payroll data on our Texas PayStub template.

Paycheck calculator texas head of household. This downtime is expected to last until 08222021 500 pm PDT. Your results have expired. Choose Marital Status Single or Dual Income Married Married one income Head of Household.

Some states follow the federal fiscal year some states start on July 01 and end on Jun 30. Detailed salary after tax calculation including Texas State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Texas state tax tables. One of a suite of free online calculators provided by the team at iCalculator.

One of a suite of free online calculators provided by the team at iCalculator. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. In part to make up for its lack of a state or local income tax sales and property taxes in Texas tend to be high.

The biggest reason why filing a 1099-MISC can catch people off guard is because of the 153 self-employment tax. Choose Cycle Daily Weekly Bi-Weekly Monthly Semi-Monthly Quarterly Semi-Annually Annually Miscellaneous. If youre finished you can send them to your employees and you can make as many changes as you like.

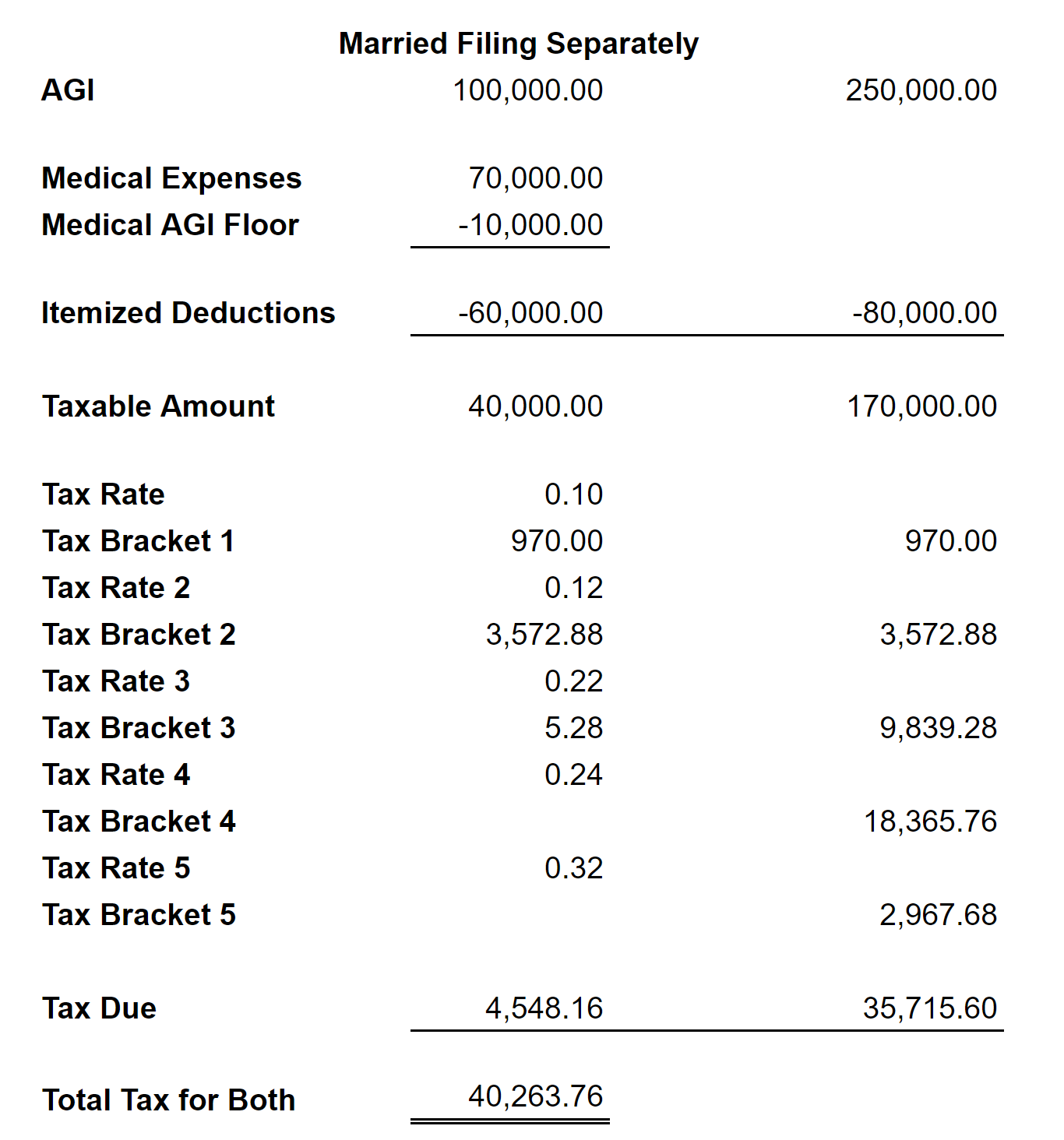

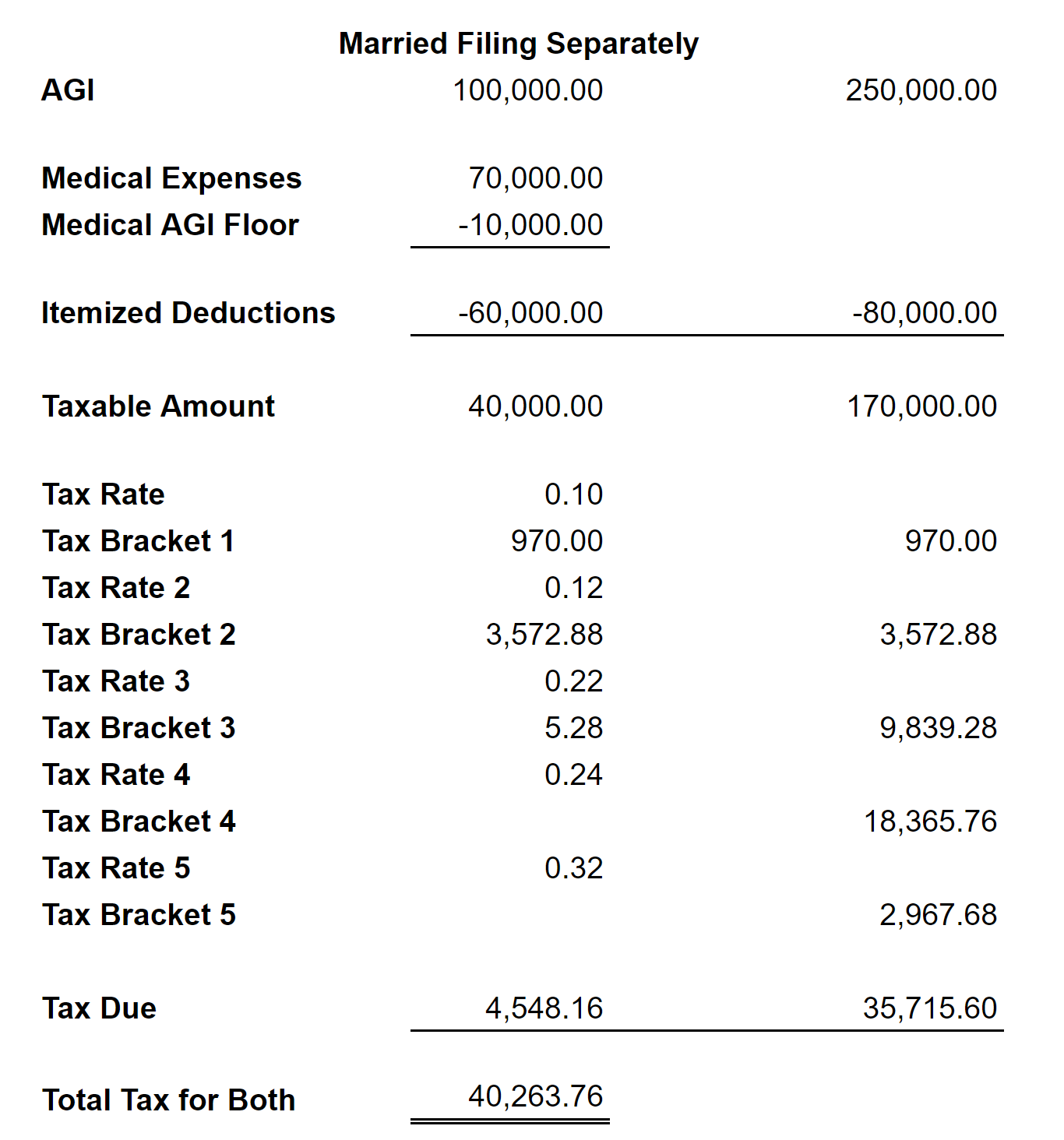

This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry. The self-employment tax applies evenly to everyone regardless of your income bracket. Hourly Paycheck Calculator.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. Use this calculator to help you determine the impact of changing your payroll deductions.

This calculator is intended for use by US. Our calculator will generate your FICA Withholding and all deductions on your Texas stub preview. ESmart Paycheck is the easy to use paycheck and payroll management software.

Daily Weekly Bi-Weekly Bi-Weekly 9 monthsyr Semi-Monthly Monthly Quarterly Semi-Annually Yearly. Your tax rate is calculated using several factors and can change each yearthe minimum tax rate is 036 and the maximum rate is 636 in 2019. It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as single or head of household.

Texas Unemployment Insurance UI is paid on the first 9000 in wages you pay each employee every calendar year. ESmart Paycheck will have extended downtime for system level migration starting on 08202021 500 pm PDT. If you are unable to connect to the website outside of the expected downtime.

In 2019 the minimum tax rate is 036 and the maximum is 636. 9500000 salary example for employee and employer paying Texas State tincome taxes. The exact tax rate is specific to your business and may change each year.

How You Can Affect Your Texas Paycheck. The fiscal year 2021 will starts on Oct 01 2020 and ends on Sep 30 2021. You can enter your current payroll information and deductions and then compare them to your proposed deductions.

Federal and State Tax calculator for 2021 Weekly Tax Calculations with full line by line computations to help you with your tax return in 2021. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Get a Payroll Deductions Comparison Calculator branded for your website.

Rate 3 Hours 3. Similar to the fiscal year federal income tax. Per pay period Annually.

It can also be used to help fill steps 3 and 4 of a W-4 form. Texas Hourly Paycheck Calculator. The calculation is based on the 2021 tax brackets and the new W-4 which in.

You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household. Be aware though that payroll taxes arent the only relevant taxes in a household budget. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions.

The Hourly Wage Tax Calculator uses tax information from the tax year 2021 to show you take-home pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. You can obtain your tax rate by visiting the Texas Workforce Commissions Unemployment Tax.

More information about the calculations performed is available on the about page. Paying Taxes On Your Self-Employment Income. Below are your Texas salary paycheck results.

Rate 1 Hours 1. Number of Qualifying Children. The results are broken up into three sections.

The 1099 tax rate consists of two parts. Free Paystub Generator Texas Online Paystub Maker. Check out the Texas Workforce Commissions website to find your current tax rate.

The state fiscal year is also 12 months but it differs from state to state. As an employer youll pay Texas Unemployment Insurance UI on the first 9000 of each employees wages each year. 124 for social security tax and 29 for Medicare.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Colorful interactive simply The Best Financial Calculators. Rate 2 Hours 2.

Make payroll and filing taxes a fast. Enter your Weekly salary and click enter simple. This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Apps Games

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Apps Games

Can A Married Person File Taxes Without Their Spouse

Rhode Island Income Tax Calculator Smartasset

Texas Salary Calculator 2021 Icalculator

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Apps Games

2019 Salary Paycheck Calculator 2019 Hourly Wage To Yearly Salary Conversion Calculator

Can A Married Person File Taxes Without Their Spouse

South Carolina Payroll Calculator Calculate Net Paycheck State And Federal Taxes Estimate Salary In South Carolina

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Apps Games

Colorado Paycheck Calculator Smartasset

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Apps Games

Nanny Tax Calculator Gtm Payroll Services Inc

2020 2021 Online 457 Payroll Tax Deduction Calculator

Colorado Paycheck Calculator Smartasset

Post a Comment for "Paycheck Calculator Texas Head Of Household"